The long-awaited spot Ether exchange-traded fund (ETF) from global investment manager VanEck has taken a significant step towards potential approval.

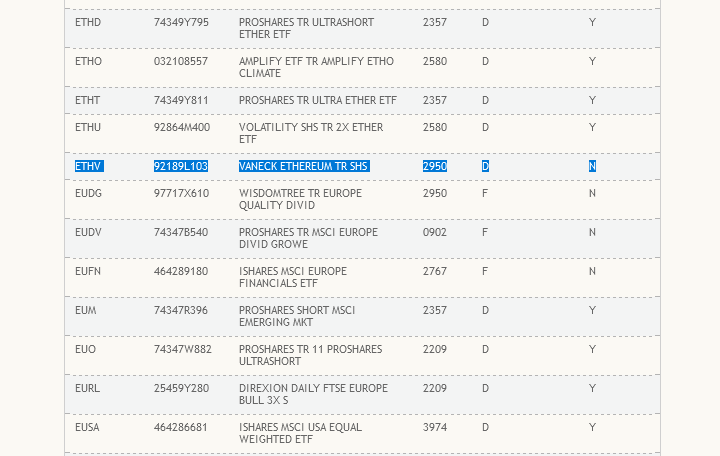

VanEck’s proposed spot Ether ETF has been listed on the Depository Trust and Clearing Corporation’s (DTCC) website under the ticker symbol “ETHV”.

TLDR

- VanEck’s proposed spot Ether ETF has been listed on the Depository Trust and Clearing Corporation’s (DTCC) website under the ticker “ETHV”.

- The listing on DTCC is a crucial step, but it does not guarantee approval from the SEC, which is still pending.

- Earlier this week, the SEC asked U.S. issuers to amend and refile 19b-4 forms on their proposed spot Ether ETFs, a move seen as a positive sign for potential approval.

- The odds of the SEC approving a spot Ether ETF have increased to around 75%, according to analysts, due to factors like staking removal and political issues.

- Ethereum’s price has surged by 31% over the past week, reaching around $3,700, amidst rising chances of ETF approval.

The DTCC is a crucial financial market infrastructure provider that offers clearing, settlement, and transaction reporting services to market participants.

A listing on the DTCC’s website is considered a crucial step before final approval from the U.S. Securities and Exchange Commission (SEC). However, it is important to note that the listing does not guarantee approval from the SEC, which is still pending.

VanEck’s ETF is currently designated as inactive on the DTCC website, meaning it cannot be processed until it receives the necessary regulatory approvals.

Nevertheless, VanEck is not the first issuer to have its spot Ether ETF listed by the DTCC. Franklin Templeton’s spot Ether ETF was listed on the platform approximately a month ago.

The DTCC clarified that its ETF list includes both active ETFs that can be processed by the DTCC and ETFs that are not yet active and, therefore, cannot be processed until they receive all necessary regulatory and other approvals.

The listing of VanEck’s spot Ether ETF on the DTCC’s website comes shortly after the Chicago Board Options Exchange (Cboe) posted amended 19b-4 forms for spot Ether ETFs from various issuers, including Franklin Templeton, Fidelity, VanEck, Invesco Galaxy, as well as Ark Invest and 21Shares.

The 19b-4 forms are filed to notify the SEC about a proposed rule change and are among the documents that need the agency’s greenlight before spot Ether ETFs can become effective.

Earlier this week, the SEC reportedly asked U.S. firms to update and refile their 19b-4 filings on their proposed spot Ether ETFs, which was seen as a positive sign that could indicate a potential approval from the regulator.

The significant change in the SEC’s stance over the past week is speculated to be linked to political factors. Crypto lawyer Jake Chervinsky noted that policy is driven by politics, and for months, crypto has been winning the political battle.

It's hard to believe this SEC would do us any favors like approving the spot ETH ETF.

But policy is politics, and crypto has been winning the political battle for months.

Maybe the Biden camp saw how many voters Trump could win with one pro-crypto comment and decided to pivot.

— Jake Chervinsky (@jchervinsky) May 21, 2024

He also speculated that former president Donald Trump’s endorsement of cryptocurrency compelled the Biden administration to shift its policy.

The odds of the SEC approving a spot Ether ETF have increased to around 75%, according to analysts at Bloomberg, citing factors like the removal of staking from the Ethereum network’s upcoming upgrade and political issues.

Amidst the rising chances of ETF approval, Ethereum’s price has surged by 31% over the past week, reaching around $3,700 at the time of writing. Standard Chartered is also bullish on Ethereum’s price, projecting that it is on track to hit $8,000 by year-end.